Mammograms have done surprisingly little to catch deadly breast cancers before they spread, a big U.S. study finds. At the same time, more than a million women have been treated for cancers that never would have threatened their lives, researchers estimate.

Up to one-third of breast cancers, or 50,000 to 70,000 cases a year, don't need treatment, the study suggests.

It's the most detailed look yet at overtreatment of breast cancer, and it adds fresh evidence that screening is not as helpful as many women believe. Mammograms are still worthwhile, because they do catch some deadly cancers and save lives, doctors stress. And some of them disagree with conclusions the new study reached.

But it spotlights a reality that is tough for many Americans to accept: Some abnormalities that doctors call "cancer" are not a health threat or truly malignant. There is no good way to tell which ones are, so many women wind up getting treatments like surgery and chemotherapy that they don't really need.

Men have heard a similar message about PSA tests to screen for slow-growing prostate cancer, but it's relatively new to the debate over breast cancer screening.

"We're coming to learn that some cancers — many cancers, depending on the organ — weren't destined to cause death," said Dr. Barnett Kramer, a National Cancer Institute screening expert. However, "once a woman is diagnosed, it's hard to say treatment is not necessary."

He had no role in the study, which was led by Dr. H. Gilbert Welch of Dartmouth Medical School and Dr. Archie Bleyer of St. Charles Health System and Oregon Health & Science University. Results are in Thursday's New England Journal of Medicine.

Breast cancer is the leading type of cancer and cause of cancer deaths in women worldwide. Nearly 1.4 million new cases are diagnosed each year. Other countries screen less aggressively than the U.S. does. In Britain, for example, mammograms are usually offered only every three years and a recent review there found similar signs of overtreatment.

The dogma has been that screening finds cancer early, when it's most curable. But screening is only worthwhile if it finds cancers destined to cause death, and if treating them early improves survival versus treating when or if they cause symptoms.

Mammograms also are an imperfect screening tool — they often give false alarms, spurring biopsies and other tests that ultimately show no cancer was present. The new study looks at a different risk: Overdiagnosis, or finding cancer that is present but does not need treatment.

Researchers used federal surveys on mammography and cancer registry statistics from 1976 through 2008 to track how many cancers were found early, while still confined to the breast, versus later, when they had spread to lymph nodes or more widely.

The scientists assumed that the actual amount of disease — how many true cases exist — did not change or grew only a little during those three decades. Yet they found a big difference in the number and stage of cases discovered over time, as mammograms came into wide use.

Mammograms more than doubled the number of early-stage cancers detected — from 112 to 234 cases per 100,000 women. But late-stage cancers dropped just 8 percent, from 102 to 94 cases per 100,000 women.

The imbalance suggests a lot of overdiagnosis from mammograms, which now account for 60 percent of cases that are found, Bleyer said. If screening were working, there should be one less patient diagnosed with late-stage cancer for every additional patient whose cancer was found at an earlier stage, he explained.

"Instead, we're diagnosing a lot of something else — not cancer" in that early stage, Bleyer said. "And the worst cancer is still going on, just like it always was."

Researchers also looked at death rates for breast cancer, which declined 28 percent during that time in women 40 and older — the group targeted for screening. Mortality dropped even more — 41 percent — in women under 40, who presumably were not getting mammograms.

"We are left to conclude, as others have, that the good news in breast cancer — decreasing mortality — must largely be the result of improved treatment, not screening," the authors write.

The study was paid for by the study authors' universities.

"This study is important because what it really highlights is that the biology of the cancer is what we need to understand" in order to know which ones to treat and how, said Dr. Julia A. Smith, director of breast cancer screening at NYU Langone Medical Center in New York. Doctors already are debating whether DCIS, a type of early tumor confined to a milk duct, should even be called cancer, she said.

Another expert, Dr. Linda Vahdat, director of the breast cancer research program at Weill Cornell Medical College in New York, said the study's leaders made many assumptions to reach a conclusion about overdiagnosis that "may or may not be correct."

"I don't think it will change how we view screening mammography," she said.

A government-appointed task force that gives screening advice calls for mammograms every other year starting at age 50 and stopping at 75. The American Cancer Society recommends them every year starting at age 40.

Dr. Len Lichtenfeld, the cancer society's deputy chief medical officer, said the study should not be taken as "a referendum on mammography," and noted that other high-quality studies have affirmed its value. Still, he said overdiagnosis is a problem, and it's not possible to tell an individual woman whether her cancer needs treated.

"Our technology has brought us to the place where we can find a lot of cancer. Our science has to bring us to the point where we can define what treatment people really need," he said.

___

Online:

Study: http://www.nejm.org/doi/full/10.1056/NEJMoa1206809

Screening advice: http://www.uspreventiveservicestaskforce.org/uspstf/uspsbrca.htm

___

Marilynn Marchione can be followed at http://twitter.com/MMarchioneAP

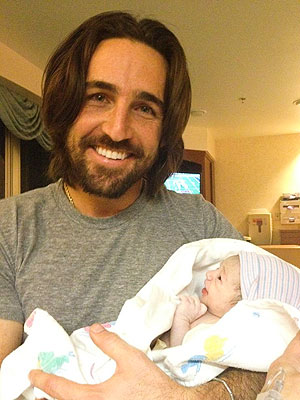

Courtesy Jake Owen

Courtesy Jake Owen